Upstart, an artificial intelligence (AI) lending platform, today announced support for auto loans as part of its consumer lending platform. With Upstart's new service, banks can offer refinance and purchase finance loans with a seamless digital experience, higher approvals, and potentially lower loss rates, all enabled by AI.

"Personal loans were the right first step for AI lending - now, we're expanding to auto," said Dave Girouard, co-founder and CEO of Upstart. "The days of randomly priced auto loans with confusing and laborious processes both for consumers and banks are nearing their end."

Upstart's new service eliminates the need for consumers to track down and enter their VIN or license plate number. Banks no longer need to manage detailed paperwork including title transfer, lien placement, or payoff of the borrower's existing loan (in the case of refinance).

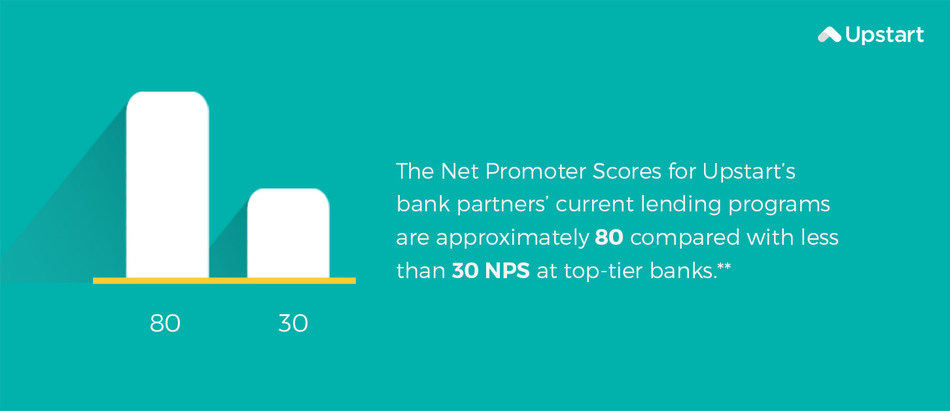

Upstart's AI model for auto loans builds off its personal loan model, which has shown itself to be 5 times more predictive than FICO during the COVID-19 pandemic.* Upstart's auto model combines a time-delimited probability of default (or prepayment) with the vehicle's modeled residual value to generate a custom loan offer for each applicant. In addition, thanks to Upstart's seamless digital experience, banks can achieve Net Promoter Scores (NPS) scores far higher than published benchmarks for the largest banks. The Net Promoter Scores for our bank partners' current lending programs are approximately 80 compared with less than 30 NPS at top-tier banks.**

Features of Upstart's Auto Lending platform include:

Aware of her elements, Neha writes the best articles across industries including electronics & semiconductors, automotive & transportation and food & beverages. Being from the finance background she has the ability to understand the dynamics of every industry and analyze the news updates to form insightful articles. Neha is an energetic person interested in music, travel, and entertainment. Since past 5 years, she written extensively on sectors like technology, finance and healthcare.

Smarter Decisions with Smart News

Smart Market News is committed to getting its readers the latest updates and insights on industries that help in making “smarter” business decisions. With insights and inputs from corporate decision makers, we bring you the stories of adopting innovative solutions and strategies that have been changing the world. Our editorial insights on products, solutions, companies, and adoption of best practices not only help in understanding the markets better, but also prove to be a complete package for your information needs.